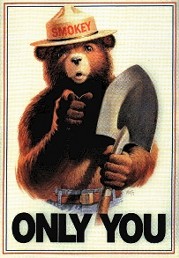

Walmington on Sea needs you to do your duty

Walmington on Sea wants you to borrow money now. It's your

patriotic duty.

As far back as 7 years ago, on Tuesday, 26 February, 2002, 08:49

GMT the BBC published this article entitled "A scandal waiting

to happen?" in which Sir Howard Davies, then chairman of UK

regulator the Financial Services Authority, was quoted warning

about the perils of dealing with toxic financial instruments.

During a speech on insurance regulation, Sir Howard remarked:

"One investment banker recently described synthetic CDOs to me

as 'the most toxic element of the financial markets today'. When

an investment banker talks of toxicity, a regulator is bound to

take a heightened interest."

A year later this inconvenient regulator with "a heightened

interest" was getting in the way of this new way of pumping up

the money supply via the backdoor, and had often been reported

warning of the asset bubble in property in the UK. So, in true

Yes Minister fashion, Sir Howard Davies was shunted off to a new

job at the London School of Economics.

Pumping up the money supply was the way elections were bought in

the Thatcherite past, and making the Bank of England independent

was supposed to stop that. But under Tony a more suitable

regulator was appointed to the FSA, one who would not complain

about the city and would instead focus on "consumer matters"

where the government had made it clear that it thinks the

regulator should concentrate their attentions. Leave the city

alone was Tony's message. Business as usual for the then Blair

government. The madness continued unabated.

When more than a couple of factors like interest rate rises and

bad debtors started to trigger problems in the system the

predicted problems arose. Why did our governments, particularly

in the US and UK deliberately let this happen? Stupidity? Or

electoral convenience? The governments were warned repeatedly,

from every direction whether it be by regulators, the media,

politicians like Vince Cable or businessmen like Warren Buffett.

So there is no excuse, there is no way they can credibly say

that nobody saw it coming.

But we now need to put that behind us and find ways to fix it

for them, and all of us. We now need the politicians to create a

market where there is something we can have confidence in buying

or investing in. Stocks and shares are not looking likely for

most folk for a while. Property is possible even probable for

most in time, and there is money sitting on the sidelines

waiting for the slump in that market to bottom out in Walmington

on Sea.

Green energy is also something the government could create the

market conditions for folk to borrow and invest in. Certainly

here in Portugal the government has made it very attractive for

folk to invest in small scale generation like wind and solar.

The annual returns on such investments are of the order of 15%

which means it's something banks are eager to finance. And

borrowing to do so is now very cheap. Perhaps Walmington on Sea

should follow suit.

Even if ordinary homes are suffering, up market property on the

Silver Coast here in Portugal is a much better investment

opportunity than it is in Walmington on Sea. But how does

borrowing more and spending or investing more to get out of debt

actually make sense where you are?

On a bank's balance sheet, savers are liabilities, and debtors

are assets. So the more good debtors they have, the more good

assets a bank has. The more savers they have, the more

liabilities (creditors) they have.

Capital is different, that is the bank's own money (now

admittedly mostly yours) which is held in roughly 8% proportion

to cover anything that might go wrong with this potentially

fragile relationship between the assets (mortgages) and

liabilities (deposits).

The cash in our economies is now little more than a system for

measuring +/- debt and a means for you, or the bank, to book a

profit (or loss) on creating and managing your debt. There is

relatively little cash in the form of notes in the system, most

money is in the form of debt and credit. It's all numbers in

computers and on balance sheets. In this system debt and credit

is the real money. This money is supposed to be as good as gold,

and until recently most of us believed it was.

Confidence in existing debt and credit is what keeps the system

going and allows new money to be created and growth to occur.

When new debt is created, new money is literally created as if

out of thin air. Banks are the people allowed to issue loans and

create this new debt in a highly favourable ratio to them.

Technically, we non economists call this system a "licence to

print money" :-) They call it fractional reserve banking.

In the modern world paper money has no intrinsic value. We can't

all go back a couple of centuries or take to the hills with our

farm animals and a few nuggets of gold. So we work with the

system we currently have. Surprisingly, this apparently mad

system has worked remarkably well for donkey's years (since the

end of the gold standard) depending totally on our confidence in

it. It allows a cautious and moderate bank to "print" or create

roughly six pounds (more or less) of new money for every cash

one that you deposit.

This is why the recovery is best financed if it is you borrowing

and helping the banks to create this new good money and not

financed by cash withdrawn from saver's bank accounts.

It is of course unfairly tough on pensioners, but it is seen as

actually better for the nation state or the world economy if

those of us who are savers are left suffering on the sidelines

feeling insecure about investing anywhere but guaranteed bank

deposits. In this way the banks can create new safer and more

sound debt (money) in a six to one ratio with the cash money

deposited by small savers.

So lots more of this new sound money is thus created, and this

helps to replace or cover over the cracks in the system, caused

by the toxic debt that is going to have to be written off.

Under the 1988 Basel Accord, banks with international presence

are only required to hold capital equal to 8% of the risk-

weighted assets.

It's much the same under Basel II which uses a "three pillars"

concept - (1) minimum capital requirements (addressing risk),

(2) supervisory review and (3) market discipline - to promote

greater stability in the financial system

This mad hatter's tea party of a system could hardly be

described as "market discipline" but it could still go on to

become a better regulated one. It can be rescued, and it will

recover if we all have the confidence to go and borrow wisely

and spend.

This is why interest rates are being reduced to such low levels.

The idea is that borrowers will emerge and invest or spend to

help get the merry-go-round going again. There are plenty of

savers now suffering on low interests rates to provide the cash.

The liquidity trap theory is that because we are reluctant to

spend in hard times, a little fiscal stimulus of governments

spending our money will initially prime the pump, and we, the

people who can borrow, will then start to kick in and invest or

spend with confidence and get the pump flowing again.

Your country, wherever you are in the world, needs you to borrow

wisely and buy stuff in order to help create new and good bank

balance sheet assets (your debt). I'm referring only to "you"

the people who have demonstrable means to make you a safe bet

for a bank to lend to. The more you borrow wisely the more good

assets you create, on and off the balance sheet, the healthier

the world economies and banks will all look.

The more you buy stuff which creates jobs, as in the

construction industry, or now in green energy, the healthier the

economy is. Do it with borrowed money, which you can afford to

pay off, and the healthier the bank's balance sheet looks too.

In our hypothetical economy of Walmington on Sea which is now a

fairly comfortable fractional reserve banking world with the

pound as its currency, the banks are allowed to lend in a ratio

of let's say, in simple terms, six debtor pounds to one saved

pound. (the financial ratio varies depending on the regulations

in force).

So for every six pounds you pay off your mortgage, the bank can

afford to lose a saver with a pound, and vice versa for every

pound withdrawn somebody needs to pay off six pounds of debt. So

this is why some of you must keep saving, and the others must

borrow.

For every pound you save they can lend six. In Walmington on Sea

the currency is pounds, but it's the same in dollars, euros or

whatever your preferred currency is.

A pensioner deposits 20k and the bank can lend someone 120k,

which lets somebody buy an average house, and creates lots of

jobs.

But you see the first and most obvious problem? If you take six

thousand pounds out of your savings account and pay off six

thousand pounds from your mortgage, their balance sheet is now

way out of kilter. They lent 36 thousand based on your six

thousand savings. But you only paid off 6 thousand of debt when

you withdrew your savings. So they now need to call in 30

thousand in other people's debts to even out the permitted ratio

on the balance sheet.

Worse still, what if you remove the savings and don't pay off

your mortgage, but put it under your mattress. They now have to

shed assets on their balance sheets (calling in other mortgages)

by a substantial multiple. In this hypothetical example 6 x 6 =

36 thousand pounds.

If anything goes wrong with our confidence in the banking system

it doesn't take long for this multiplication effect to send even

the healthiest of banks into a spiral of asset decline. Hence we

have regulations on the amount of capital they have to keep in

proportion to the amount of debt (mortgages) they have taken on.

Think therefore what it does to unhealthy banks with lots of

potentially bad debts when it all goes pear shaped. And that's

what we now have to recover from, a totally pear shaped economy

because the unwise and powerful decided that this capital

requirement slows down a bank, and a slow bank makes less profit

than a fast bank.

So to speed things up, and theoretically to protect themselves

at the same time, the banks were permitted to sell on and share

their debts with other banks using systems of collateralised

debt. There is an alphabet soup of acronyms like CDO to describe

these mechanisms.

If they could sell the debt to someone else they then have to

hold less capital themselves. So they can lend more, do more

deals, with less of their own capital forced to sit doing

nothing. Less money invested to turn a bigger profit.

If another bank or institution buys someone else's debts in the

form of a CDO or similar they can show it on their balance sheet

as an asset. Remember a debt is an asset and a deposit is a

liability.

The system went wrong because bankers printed an alphabet soup

of collateralised debt. They created a paper only asset bubble

which was, in effect, printing funny money. The more funny money

a banker printed by doing these pass the paper parcel deals the

bigger the bonuses the bankers were paid.

This funny money, because it's "securitised debt" shows on

other banks books as an asset. (Sometimes a different division

of the same bank - I'm sure you see the danger there!). It was a

confidence trick which like a Ponzi scheme escalated to become a

gaping hole in the world economy just waiting to implode, and

those who perpetrated and permitted it ought to be prosecuted.

Despite governments being warned by the regulators and others,

(in the UK as far back as 2002 at least), of the dangers of this

bubble of unregulated funny-money debt, governments didn't do

anything about it. Thus they created the mess, and now we have

low interest rates to encourage us to borrow more and cover it

up by way of fixing it. The profits on new good money created

will pay off the losses on the old toxic money.

But until your government gets their act together and inspires

the necessary confidence in your country, it's up to you. Your

country needs you to help get the world out of a potential

"Liquidity trap" caused by low interest rates, while they go

around dropping their helicopter money as a fiscal stimulus.

Whatever your asset or investment choice, your country needs you

to borrow money as soon as possible and get on and invest it. And

by so doing you will be creating the much needed jobs which will

eventually pay for it all.

Comments

Is the irony of the Dad's Army and Kitchener posters intended?

The above message posted by: Arthur Wilson | October 5, 2014 10:51 AM

Healthy borrowing by everyday folk and responsible organisations creates good money. That good money is needed to fix the mess made by those in power who printed money by lending irresponsibly.

The situation does seem somewhat ironic.

The above message posted by: David |

October 5, 2014 11:03 AM

|

October 5, 2014 11:03 AM